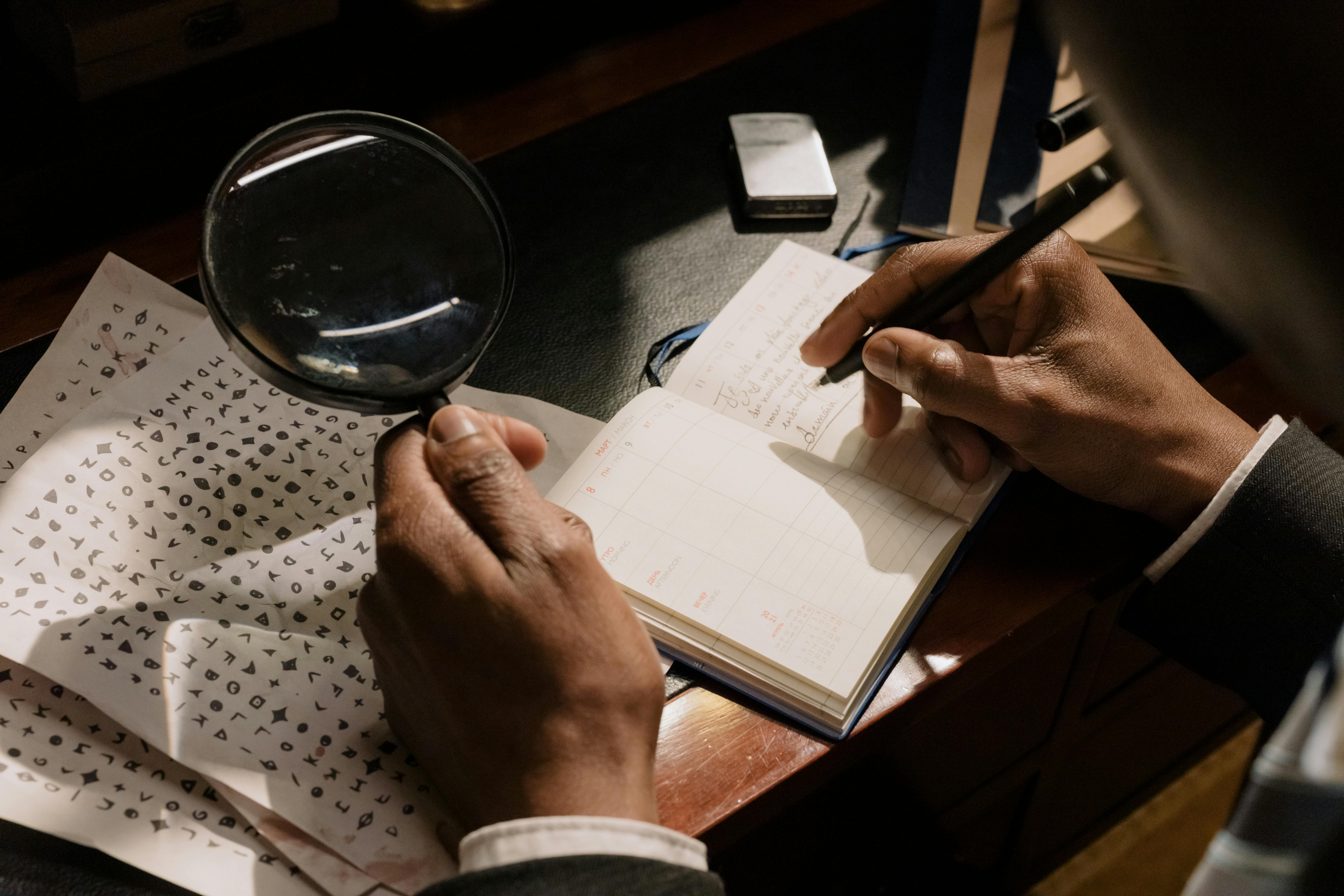

Your Legal Rights

Understand the laws that protect you, and how our experts leverage them to fight on your behalf.

The NCA is your most powerful shield. Our experts are masters of the NCA and use it to defend your rights as a borrower.

When a credit bureau or provider is unreasonable, we escalate your case to the Credit Ombud. Learn how we manage this process.

The Prescription Act can extinguish your debt. Our legal experts use it to protect you from unlawful collection and clean your credit report.

Explore the concept of credit information amnesty and how past and future regulations affect the information on your credit report.

Learn what a garnishee order is, how it's obtained, and what your rights are if one is issued against you.

An in-depth look at the NCR, its functions, and how it works to protect consumers in the credit market.

What constitutes reckless lending under the NCA, and what are your rights if you have been a victim of it?

The NCA guarantees that credit agreements must be easy to understand. Learn what this means for you.

Explore how the Consumer Protection Act (CPA) and National Credit Act (NCA) intersect to protect you.

Under the NCA, lenders must check if you can afford a loan. Learn how these assessments work and what they check for.

A breakdown of the different types of interest (fixed, variable) and the maximum fees lenders can charge you under the NCA.